Recently, the enthusiasm of domestic investment in the integrated circuit industry continues to rise, especially since The State Council issued Several Policies to Promote the High Quality Development of the Integrated Circuit Industry and Software Industry in the New Era this year, the integrated circuit industry has become a new industry tuyere.

"Improve the innovation capability and development quality of the upstream and downstream of the IC industry chain, guide the healthy development of the industry" has become the consensus of the IC industry, especially the printed circuit board industry.

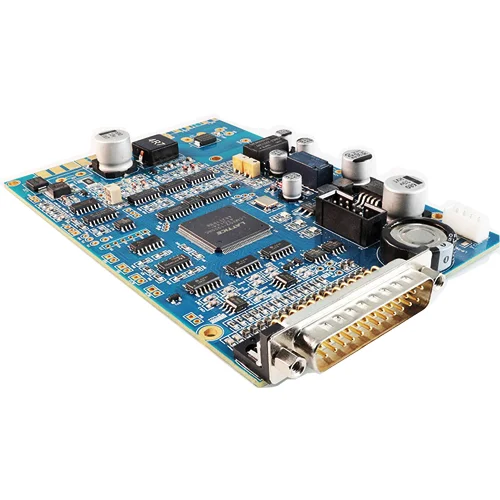

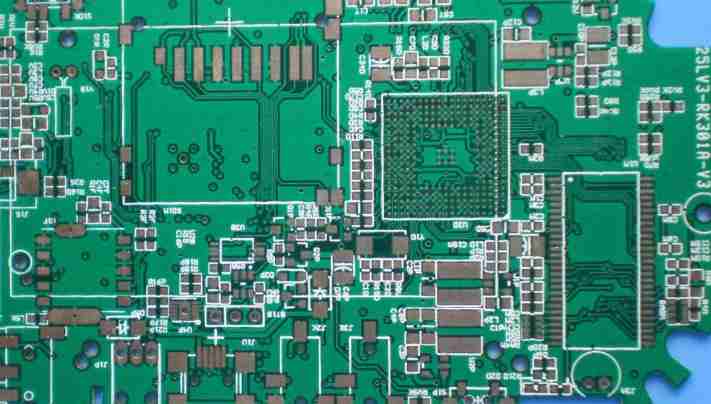

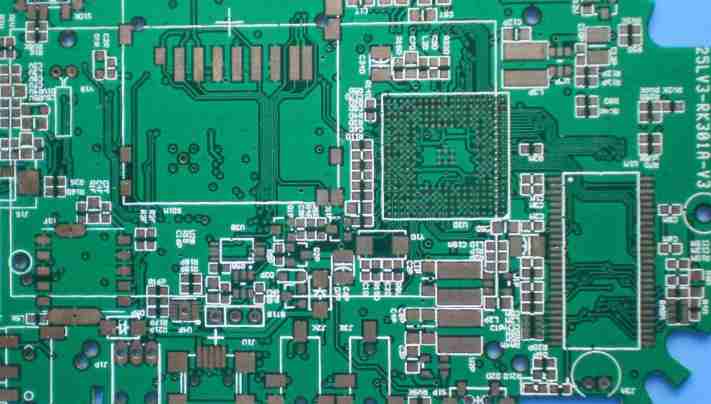

As the carrier of integrated circuit (IC), Printed circuit board (PCB) also ushered in great policy dividends. Printed circuit boards, also known as the "mother of electronic products", basically have a "core" of electronic products need it.

In the post-epidemic era, as one of the leaders in the printed circuit board industry, Oskom (002913.SZ), which has been supplying large quantities of Huawei, has achieved bucking the trend of growth in its performance? How does the management view merger and reorganization? What is the future direction of domestic replacement of printed circuit board materials? With these questions, a few days ago, China Economic Weekly interviewed the chairman of Oskom Cheng Yong.

The mystery of contrarian growth in performance

China Economic Weekly: At the beginning of this year, the novel coronavirus outbreak suddenly hit. The electronic industry is affected by the macro-economy, and the demand has fallen, especially the automotive electronics and home appliances, which have been greatly affected. Why is Oskom's market order "the scenery here is unique" and its performance has achieved the contrartrend growth?

Cheng Yong: In the first quarter, affected by the epidemic, many enterprises in the printed circuit board industry are facing a sharp decline in orders, even halved. From the first three quarters of Oskom revenue situation, more than 25% growth. The most important reason why Oskom bucked the trend of growth while the industry was declining is the company's transformation layout in 2017. Three years later, under the background of the epidemic, Oskom began to "produce food".

If we hadn't decided to transform ourselves in 2017, we'd be dead by now. I've been making PCBS for over 20 years and no other industry has tried it. If you can do two or three things well in a lifetime, that's good. If you can do printed circuit boards well, that's good. So I wasn't put into the minefield of crossover transformation by capital.

Oskom also had structural problems with its order book in the first half. Affected by the industry downturn, traditional orders such as automotive electronics were flat with previous years, but consumer electronics orders such as home appliances and mobile phones made up for the declining trend of automotive electronics market orders; However, the communication field driven by the commercialization of 5G has a good performance. The order volume of ICT (Information and CommunicationsTechnology, also known as information communication), which was laid out in 2017, began to increase this year. ICT products will become the mainstream products of Oskom in the future. So from the overall point of view, the first three quarters of the company performance showed a growth trend.

"Development Adheres to long-termism"

China Economic Weekly: In the three years since Oskom's landing in the capital market, there have been few attempts in merger and reorganization, private placement and issuance of bonds. How does Oskom make use of the leverage of the capital market? What is the company's long-term strategic development plan?

Cheng Yong: It has been three years since Oshicom went public, and there have been few attempts at mergers and acquisitions, private placement and bond issuance, which can be described as "inflexible".

There is an unwritten rule within the company that anyone who talks to me about a merger in three to five years is gone. Our main business has not done well, why to do mergers and acquisitions. Oskom's main business is at least in the top three in printed circuit boards, so it can afford to look at acquisitions.

What is the core of a successful merger? Is whether the listed company can control the acquisition target. This puts forward high requirements for the construction of enterprise talent echelon. Without talent accumulation, the target of merger and acquisition cannot become a "boom", cannot form industrial synergy with the company's main business, and may even become a negative asset of the company. Such merger and acquisition is meaningless.

Oskom is committed to long-term development -- this is my future development of the company's tone. We're not in the short term. If you look at the printed circuit board industry, it's basically irreplaceable in the next 20 years, and the ceiling is big enough.

Manufacturing is not a sham. Oskom should adhere to the main business for a long time, to the standard PCB industry leader, with the mentality of "running" constantly improve the management and development of the company, absorb and digest the survival logic and industrial thinking of competitors, when fully fledged, we will naturally grow into the PCB industry "main runner".

My strategic focus is logical, but also in line with the interests of the majority of shareholders, is also in line with the interests of the strivers of the whole company. It seems to me that the interests of strivers may be more important than those of shareholders.

At present, Oskom's technology and talent pool determine that our future market and scale have a lot of room to increase, especially our marketing development can be described as "invincible". The only weak spot for now is capacity.

PCB raw materials have been replaced by domestic products

China Economic Weekly: Integrated circuit industry has become a tuyere, does this mean that the process of printing circuit board localization speed up? How to view the localization of PCB industry?

Cheng Yong: In 2019, China's IC sales revenue was 756.2 billion yuan, with a year-on-year growth of 15.8%, making it one of the fastest growing regions in the world for IC development.

A country is strong only when its manufacturing enterprises are strong. Looking around the world, China has an absolute say in PCB industry. At present, the scale of PCB industry in mainland China has become a monopoly. Foreign enterprises do not have the advantages of raw materials and supporting industrial chain, and do not want to do the printed circuit board industry.

From the perspective of raw materials of printed circuit boards, they are all in the hands of the Chinese people. Since 2017, the national level began to promote the domestic replacement of printed circuit boards materials in a foreseeable way. After two or three years of development, the materials of printed circuit boards industry have basically realized localization.

The successful realization of domestic substitution of printed circuit board production materials in China can be attributed to two reasons: one is the policy orientation of the country, and the other is the acceleration of domestic iteration driven by commercial interests. Before domestic replacement, the raw materials of printed circuit boards in European and American countries may be 100 yuan/square meter, and the Chinese people come out with 60 yuan/square meter. We sell them to the downstream with 80 yuan/square meter, and there is 20 yuan profit space in the middle.

In the post-COVID-19 era, we need to change the habitual thinking that "domestic goods are not good" and give domestic brands a chance to have a try. The epidemic crisis, in particular, has intensified the trend of domestic substitution in various industries.