Automotive is the fourth largest downstream application of PCB board, the global output value of automotive PCB is about 7.6 billion US dollars in 2018. With increasing consumer requirements for vehicle functionality and safety, and increasing degree of vehicle electronization, the automotive PCB market has benefited. In the past decade, the proportion of automotive PCB demand has increased from 3.8% to 12.2%, achieving a growth rate far higher than the PCB industry average.

Electric + intelligent acceleration of automobile electronization, automotive PCB market size is expected to double in seven years

New energy vehicles and intelligent vehicles are the new blue ocean of automotive electronics, opening a broad growth space for the automotive PCB market with rising volume and price. Compared with traditional vehicles, the power system of new energy vehicles has added on-board charger, battery management system (BMS), voltage conversion system (DC-DC, inverter, etc.), high voltage and low voltage devices and other electronic parts, which greatly improves the degree of electronization and drives the increase of PCB consumption for vehicles. In addition, the wide application of intelligent assisted driving, as well as the future driverless era is far away, the automotive active safety system PCB has a broad prospect. We estimate that the global automotive electronic PCB market will reach 100 billion yuan by 2025, nearly doubling from 2018.

Go new and grasp the Tesla supply chain

The technical difficulty of vehicle scale products, coupled with the stability of the automobile supply chain, makes the threshold for manufacturers to enter the automobile supply chain very high. Once they enter, they have demonstration effect. Therefore, it is worth paying attention to the PCB manufacturers that take the lead in entering the supply chain of the top automobile enterprises. Tesla is a leader in the field of new energy vehicles and intelligent driving. Its first popular model Model3 has been in high volume, combined with the domestic exceeding expectations and the accelerated release of the second popular model ModelY. The relevant suppliers of Tesla are facing development opportunities, and it is recommended to focus on Shiyun Circuit, a leading enterprise of automotive PCB and a second-level supplier of Tesla. Katsuhiro Technology, etc.

Risk tips: automobile industry prosperity is less than expected; New-energy vehicle sales fell short of expectations; The progress of automobile intelligence is less than expected; Exchange rate risk.

Automotive electronics is one of the important demands of PCB market

In recent years, the innovation of the automobile industry is mainly concentrated in the field of automobile electronics. On the one hand, the improvement of environmental protection and safety regulations in Europe and the United States has promoted the assembly of automobile electronics; on the other hand, the rise of consumer electronics has promoted the increase of consumers' demand for on-board communication and entertainment functions, and constantly improved the penetration rate of automobile electronics. In addition, the advent of the new four modernization era of automobiles, especially the electrification and intelligence, further strengthen the trend of automobile electronization, automotive electronic PCB industry ushered in the development opportunity of rising volume and price.

1. The mother of electronic products -- PCB

Printed circuit board (PCB), is the use of electronic printing, in the heat insulation, not easy to bend on the surface of the copper coated plate etching treatment, leaving a network of small lines, so that a variety of electronic components form a predetermined circuit connection, to achieve the electronic components of the relay transmission role.

PCB is the base board for assembling electronic parts, is the key interconnect of electronic products, and is also the electrical connection provider of electronic components. The vast majority of electronic equipment and products need to be equipped, known as the "mother of electronic products". The manufacturing quality of PCB not only directly affects the reliability of electronic products, but also affects the overall competitiveness of system products. The development level of its industry can reflect the development speed and technical level of a country or region's electronic information industry to a certain extent.

There are many kinds of PCB products, generally divided into rigid circuit board, flexible board and rigid flexible combined board. In the automotive circuit board, the traditional single-layer PCB, double-layer PCB and multi-layer PCB are widely used. In recent years, the wide application of HDI has become the first choice of automotive electronic products.

The PCB industry is mainly distributed in Europe, America, Japan and South Korea, Mainland China, Taiwan and other regions. Before 2000, America, Europe and Japan accounted for more than 70% of the output value of the global PCB production. However, in the past decade, due to the advantages of labor, resources, policies and industrial clustering, the global electronic manufacturing capacity has been transferred to the Chinese mainland, Taiwan and South Korea and other Asian regions. In 2006, China surpassed Japan to become the largest production base of the global PCB industry. In 2018, the PCB output value of the Chinese mainland was 32.6 billion US dollars, and the global PCB output value was 63.5 billion US dollars, with China's market share accounting for 51.3%.

The main upstream raw material of PCB is copper-clad plate, which is widely used downstream. From the perspective of the industry as a whole, the raw material cost accounts for more than half of the PCB production cost, among which the copper clad plate is the main raw material of Z, and other raw materials include copper foil, copper ball, semi-cured sheet, gold salt, ink, dry film and other chemical materials. PCB are widely used downstream, so the cyclical fluctuation of demand is weak. Downstream industries mainly include computer, communication equipment, industrial control, automotive electronics, consumer electronics and aerospace, etc.

2. The automobile supply chain has high threshold and strong stability, and strengthens the first-mover advantage of supporting enterprises

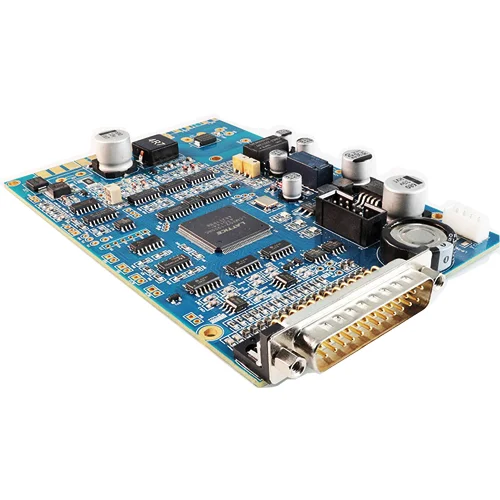

The reliability and safety requirements of automobiles are higher, so the threshold to enter the automobile supply chain is higher. Due to the special working environment, safety and high current requirements of automobile, its requirements on the reliability of PCB, environmental adaptability and other requirements are very strict. If suppliers want to enter the automotive supply chain, they must go through a series of verification tests, such as ISO/TS16949 certification, certification cycle generally needs 1-2 years.

3. The proportion of PCB demand from automobiles is increasing year by year

Automobiles are the fourth largest downstream application of PCBS, accounting for about 12% of global PCB demand in 2018. According to Prismark statistics, the output value of automotive PCB products accounted for 3.8% of the total output value of PCB in 2009, and significantly increased to 12.0% in 2018, with an output value of about 7.6 billion dollars. Benefiting from the rapid growth of downstream automotive electronics demand, the annual growth rate of automotive electronic PCB is faster than the overall level of the industry. In 2018, the output value of automotive electronic PCB achieved a year-on-year growth rate of 8.4%, higher than the 6% growth of PCB industry. Metal substrate

Automotive electronics for PCB requirements of diversity, large quantity of low price products and high reliability/safety requirements coexist. In the instrument panel, car audio, driving computer and other application environment, a large number of hard board; In the engine room, due to the high temperature environment and the heat dissipation requirements of LED lamp source, the heat dissipation substrate occupies a higher proportion; Low temperature co-fired ceramics (LTCC) are widely used in high frequency transmission and wireless radar detection.

Automobile supply chain stability is strong, leading supporting enterprises have the advantage of first mover. Because of the high entry barrier for automotive PCB circuit boards, auto manufacturers generally do not change certified suppliers at will. Therefore, once a manufacturer can successfully enter the supply chain of a large international factory, it will not only bring the company long-term stable orders, but also strengthen the first-mover advantage for the company due to the industrial characteristics of high threshold.