PCB leaders welcome growth opportunities

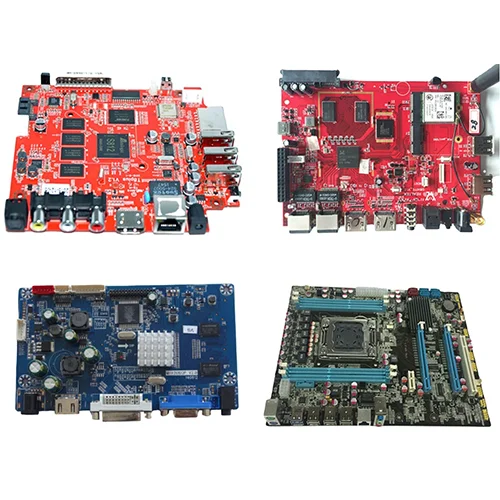

The general trend of industry moving eastward has driven the prosperity of the mainland The focus of PCB industry has been transferred to Asia, and the production capacity in Asia has been further transferred to the mainland, forming a new industrial pattern With the continuous transfer of production capacity, mainland China has become the global PCB production capacity According to Presmark's estimate, China's PCB output value will reach US $28972 billion in 2017, accounting for more than 50% of the global output value

In depth report on PCB industry: industrial transfer is accelerating, and PCB leaders welcome growth opportunities

Data centers and other applications have added new HDI requirements, and FPC has broad prospects. The data center is developing towards high-speed, high-capacity, cloud computing and high-performance,

Circuit board

The demand for buildings is surging, among which the demand for servers will also increase the overall demand for HDI The popularity of mobile electronic products such as smart phones will also push up the demand for mobile phones In the trend of intelligence, the advantages of thin and light mobile electronic products and flexible circuit boards, such as light weight, thin thickness and bending resistance, are conducive to their wide application The demand of display module for FPC, touch module, fingerprint identification module, side button, power button and other smart phone segments are showing a growing trend

The concentration of "raw material price increase+environmental protection testing" has been improved, leading manufacturers to take advantage of the situation. The rising prices of raw materials such as copper foil, epoxy resin and ink in the upstream of the industry have brought cost pressure to PCB manufacturers. At the same time, the central government vigorously carried out environmental protection inspections, implemented environmental protection policies, cracked down on chaotic small manufacturers, and exerted cost pressure. In the context of rising raw material prices and stricter environmental inspection, the restructuring of the PCB industry has brought higher concentration. The bargaining power of small manufacturers in the downstream is weak, and it is difficult to absorb the price rise in the upstream. Small and medium-sized PCB companies will exit due to shrinking profit margins. In this round of PCB industry reshuffle, leading enterprises have technological and financial advantages, and are expected to achieve scale expansion through expansion of production capacity, mergers and acquisitions, product upgrading and other channels. By virtue of their efficient production process and excellent cost control foothold, they directly benefit from the improvement of industry concentration. The industry is expected to return to rationality and the industrial chain will continue to develop healthily.

New applications have promoted the growth of the industry, and the 5G era is coming. The new 5G communication base stations have a large demand for high-frequency circuit boards: compared with the number of millions of base stations in the 4G era, the size of base stations in the 5G era is expected to exceed 10 million. Compared with traditional products, high-frequency and high-speed circuit boards meeting 5G requirements have larger technical barriers and higher gross margins.

The overall trend of automotive electronics has driven the rapid growth of automotive PCB With the deepening of automotive electronic technology, the demand for automotive PCB will gradually increase Compared with traditional vehicles, new energy vehicles have higher requirements for the degree of electronization The cost of electronic equipment of traditional high-end vehicles accounts for about 25%, and the proportion of new energy vehicles reaches 45% - 65% Among them, BMS will become a new growth point of automobile PCB, and high frequency PCB equipped with millimeter wave radar has put forward a lot of requirements for rigidity